Answer:

This person would deposit $5,255.47 for ten years.

It will generated a value of $83758.62 which will coumpound interest for 23 years unit reach $750,000

After that, the person will withdraw 75,000 per year until his death

Step-by-step explanation:

Timeline:

for 10 year the person will do annual deposit.

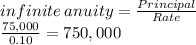

24 years after that, wants to withdraw 75,000 forever AKA indefinite

This is the future value needed for the person at the end of year 33 (Because at the beginning of year 34 It will withdraw 75,000)

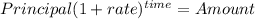

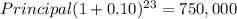

This value will be the result of 23 years of interest of a lump sum

Principal = 83758.61835

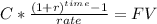

This value will be the proceeds of the 10 years annuity

This is the future value of the annuity. This is the kicker of the investment. It starts from here.

C = 5,255.467583