Answer:

Step-by-step explanation:

The timeline would be as follows:

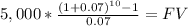

During the first 10 years, we deposit 5,000 at 7% market rate.

Then we withdraw at the beginning of Year eleven during 17 year. The market price for this period is 6%

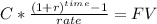

First Step amount at end of year 10

FV = $69,082.24

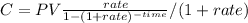

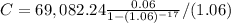

Then, we are going to calculate how much can be withdraw during 17 years

At the beginning of the period at 6% rate

From the PV formula, we clear the Cuota and then we divide by 1.06 because we are doing an annuity-due. The amount is withdraw at the beginning of the period. That's why we add a new element.

C = 6220.32