Answer:

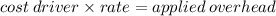

The applied manufacturing overhead will be $392,543

Step-by-step explanation:

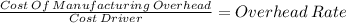

Remember that the rate is done by dividing the overhead cost over a cost driver. Direct labour hours is the cost driver for this task.

372,000/181,000 = 2.0552

191,000 x 2.0552 = 392,543.2