Answer:

James will pay off his mortgage 136 months early.

Explanation:

Given : Amount to be paid(A)= $205000

Interest rate per annum = 5.78% = 0.0578

monthly interest rate(i) =

= 0.004817 (approx)

= 0.004817 (approx)

Monthly payment (P) = $1500.

we have to find how many months early will he pay off his mortgage

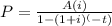

We know,

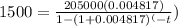

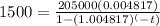

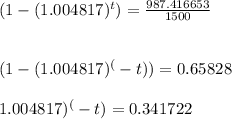

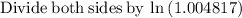

Substitute values , we get,

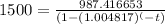

Solving for t ,

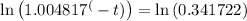

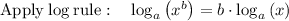

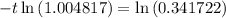

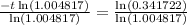

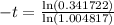

Applying ln both sides,we get,

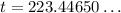

Thus, t = 224 months.

1 year = 12 month thus, 30 years = 360 months.

Difference = 360 - 224 = 136 months

Thus, James will pay off his mortgage (360-224) 136 months early.