Answer:

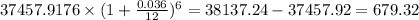

Remaining balance would have been $37457.92

Explanation:

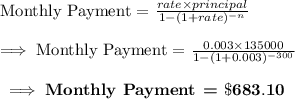

number of month, n = 25 × 12 = 300 months.

APR = 3.6% annually

= 0.3% monthly ( Divide the annual rate by 12)

Principal value = $135000

If he pay 683.10 every month for 240 months, the remaining balance on the loan is = 37,457.92

If you assume they are using monthly interest rate for 6 months, then the penalty assessed would be :

Since, the loan was originally scheduled to go 300 months, then paying off the loan by the end of month 240 would be 5 years early, because 5 years is equal to 60 months and 300 - 60 is equal to 240 months

The key component here is what would be the remaining balance after 240 months of paying the loan off at $683.10 every month.

That remaining balance would have been $37457.92