Answer:

$4.911 million or $6.481 million

Thus, we are 95% confident that the mean amount of all venture-capital investments in the high-tech industry is somewhere between $4.911 million and $6.481 million.

Explanation:

Given that:

sample size n = 18

standard deviation σ = 1.70

confidence interval = 95%

Sample mean

5.696

5.696

The level of significance = 1 - C.I

= 1 - 0.95

= 0.05

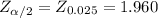

The critical value of

from the Z tables

from the Z tables

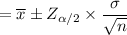

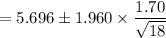

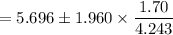

The 95% C.I for the mean is;

= 5.696 ± 0.785372

= (5.696 - 0.785372 , 5.696 + 0.785372 )

= ( 4.910628 , 6.481372 )

≅ $4.911 million or $6.481 million.

Thus, we are 95% confident that the mean amount of all venture-capital investments in the high-tech industry is somewhere between $4.911 million and $6.481 million.