Answer:

The answer is "$208,289.045 and $9,121,939.2"

Step-by-step explanation:

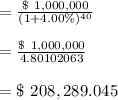

In point a:

40 years before CV buying power:

CV buying power was $208,289.045 and for 40 years before the start of each year forty years ago.

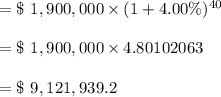

In point b:

Power CV = $1.9 million

Future accumulated value:

The future accumulated value will be= $9,121,939.2.