Answer:

The answer is "$86.44".

Step-by-step explanation:

The more recent dividends paid

Level of growth

Required returns level for a first 3 years = 12

Required returns rate for year 3 to year 6 = 10

Required returns level after years 6= 8

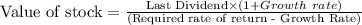

Formula:

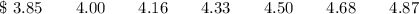

Divididend payment for year O to year 6 is calculated below:

Year

Rate of return needed 12

12

12

12

12

10

10

10

10

10

10

Collection of dividend

Benefit of terminal 126.6584

Benefit of terminal 126.6584

Dividend purchase price 3.58 3.32 3.08 3.08 2.91 2.75 Terminal value at year-end 3 95.16

Present dividend value 67.73

Value of Stock $86.44