Solution :

We know,

Net debt = debt market value - excess cash

= 110 - 10

= 100 million dollar

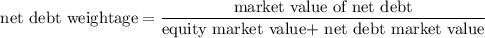

= 0.25

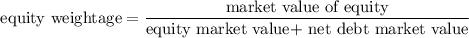

= 0.75

Therefore, WACC = 0.75 x 12% + 0.25 x 5% x (1 - 31%)

= 0.75 x 12% + 0.25 x 5% x (1 - 0.31)

= 0.75 x 12% + 0.25 x 5% x 0.69

= 9% + 0.862%

= 9.862%