Answer:

- $427.97

- $223.22

Step-by-step explanation:

1. Target stock price in 5 years

First find the dividend in the 5th year;

= 1.75 * ( 1 + 21%)⁵

= $4.5390493

The calculate Earnings per Share;

= Dividend in 5th year/ Payout ratio

= 4.5390493 / 35%

= $12.968712

Now calculate the Share price;

= PE ratio * EPS

= 33 * 12.968712

= $427.97

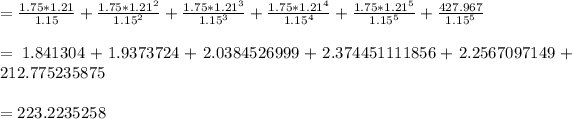

2. Stock Price today assuming required return rate of 15%

This is the present values of all the dividends in addition to the stock price in 5 years.

= $223.22