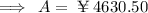

Answer:

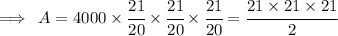

¥4630.50

Explanation:

Here,

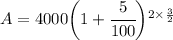

- P = ¥4000

- n = 1 1/2 = 3/2 years

- r = 10% per annum

ATQ, as well,the interest is payable in half-yearly.

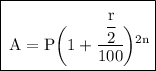

We know that,

- [By this formula,it could easily solved]

Substitute the values

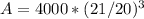

Now solve.

Hence,the sum of ¥ 4000 will be amounted to ¥4630.50 in 1 1/2 years.

This question arises:Why we used that formula?

Reason:

The compound interest is calculated half-yearly, the formula changes a little.In this case for r we write r/2 and for n we write 2n because a rate of r% per annum is r/2% half-yearly and n years = 2n half year So this is the reason.