Answer: $228.35

Step-by-step explanation:

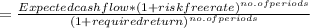

The Certainty Equivalent Cashflow is the amount that the project is expected to generate if it were invested in a risk free asset and then discounted at the company's required return.

Required return = Risk free rate + beta * market premium

= 5% + 1.25 * 8%

= 15%

Certainty equivalent cash flow

= $228.35