Answer:

The answer is "$14.67"

Step-by-step explanation:

Its total average common stock must also be determined to Hampshire 's fundamental EPS ((net revenue-preferred dividends)/weighted total shares outstanding).

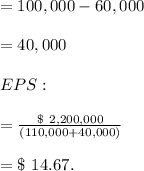

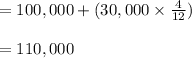

On January 1 now there are 100,000 pending shares and on 1 September 30,000 so the weighted average is as follows:

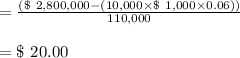

Basic EPS is:

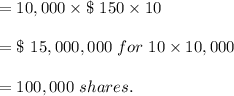

If the money was exercised, it will result in a cash flow

Its amount of shares which can be purchased through expected revenue (money inflow / current share price) is based on the cash accounting method

The number of shares to be produced: