Answer:

The answer is "$ 281.65"

Explanation:

It chances of women surviving the year are

The possibility of the woman staying in the year is:

Unless the woman survives, the company will turn a profit

When a woman dies, the business loses:

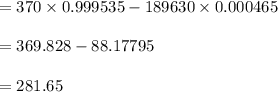

Calculate the assurance company's estimated benefit of the scheme:

The assurance company anticipated the importance of the policy: