Answer:

Following are the solution to this question:

Explanation:

For incentive A

The car value = 57000

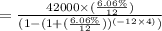

Calculating debt

Calculating the debt value after incentive

For incentive B

The car value = 57000

Calculating the debt value

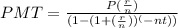

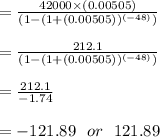

Calculating the monthly payment =

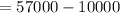

difference: