Answer:

The price of the asset to change (in percentage ) is 0.463%

Step-by-step explanation:

As per given data

Duration = 5 years

Chnage in the yield rate = -0.10%

Price of the asset change can be calculated using following formula

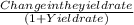

Percentage price change = -Duration x

Placing values in the formula

Percentage price change = -5 years x

Percentage price change = 0.00463

Percentage price change = 0.463%