Answer:

- 0.66 : 1

- 0.25 : 1

Step-by-step explanation:

1. Current Cash Debt Coverage ratio;

Net Cash from operating activities = Net Income + Depreciation - Gain on sale of investments - Increase in Accounts receivable

= 33,840 + 11,331 - 3,731 - (43,440 - 23,040)

= $21,040

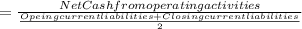

Current Cash debt coverage

= 0.66 : 1

2. Cash Debt Coverage ratio;

Opening liabilities = 31,840 + 42,840 = $74,680

Closing Liabilities = Accounts payable + Net notes + Bond

= 31,840 + (42,840 - 16,331) + 36,840

= $95,189

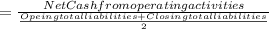

Cash debt coverage

= 0.24772

= 0.25 : 1