Answer:

7.40%

Step-by-step explanation:

The coupon rate of the bond can be calculated as follows

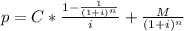

Formula:

DATA

M = $1000

n = 22.5 *2 =45 semi-annual periods,

i = 6.9%/2 = 3.45% (semi-annually)

P = $1,057

Solution

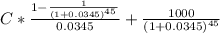

1057 =

1057 = C * 22.69 + 217.33

839.67 + C * 22.69

C = $37.01 This is a semi-annual coupon

Annual Coupon = 2 * $37.01 = $74.02

Annual Coupon Rate = 7.40%