Complete Question

The chance of an IRS audit for a tax return with over $25,000 in income is about 2% per year. We are interested in the expected number of audits a person with that income has in a 9-year period. Assume each year is independent.

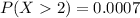

Find the probability that a person is audited more than twice. (Round your answer to four decimal places.)

Answer:

The probability is

Explanation:

From the question we are told that

The probability of an IRS audit for a tax return with over $25,000 in income is p= 0.02

The sample size n = 9

Generally the distribution of IRS audit for a tax return follows a binomial distribution

i.e

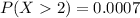

and the probability distribution function for binomial distribution is

Here C stands for combination hence we are going to be making use of the combination function in our calculators

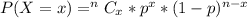

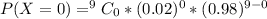

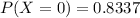

Generally the probability that a person is not audited at all is mathematically

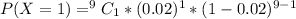

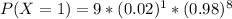

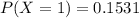

Generally the probability that a person is audited once is mathematically

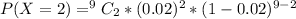

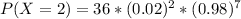

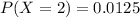

Generally the probability that a person is audited twice is mathematically represented

Generally the probability that a person is audited more than twice is mathematically represented

![P(X > 2) = 1 - [P(X = 0 ) + P(X = 1 )+ P(X =2)]](https://img.qammunity.org/2021/formulas/mathematics/college/4z2f3rnz8d6x1nhgv0ccwgh8h9o1oqrygx.png)

=>

![P(X > 2) = 1 - [0.8337 + 0.1531+0.0125 ]](https://img.qammunity.org/2021/formulas/mathematics/college/g5l0jbgm32etsa3ll52nlrwburwsumjb1r.png)

=>