Answer:

4.3883 years

Step-by-step explanation:

The investment horizon to be indifferent between both investments is the number of years it takes for the total investment sum + interest on both investments to be the same. If that value is 'n', then

the value of class A mutual fund at n years =

the value of class C mutual fund after n years =

At the point of indifference, the values of both investments will be the same.

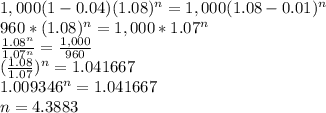

Therefore,

This is the value of n that solves the equation (deduced by interpolation).

Therefore the investment horizon of indifference = 4.3883 years.