Answer:

9.78%

Step-by-step explanation:

Given that:

Current Trade price per share =$45

Par value = $30.00

Annual dividend = $4.40

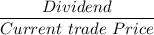

The rate of return of a preferred stock =

The rate of return of a preferred stock =

The rate of return of a preferred stock = 0.097777

The rate of return of a preferred stock = 9.7777%

The rate of return of a preferred stock

9.78%

9.78%