Answer:

The answer is "7568"

Step-by-step explanation:

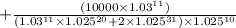

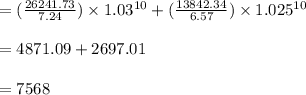

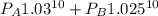

It took the funds through account the interest becomes compound. s Lets people, therefore, consider the primary in funds A as PA & the main sum of finances B as PB, the details presented as follows:

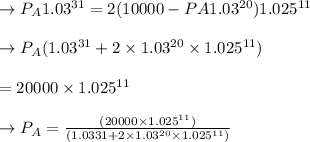

We get , and we'll have the P_B value throughout the second equation:

, So putting in this equation the above

, So putting in this equation the above

value

value

![P_B = \frac{[ {10000 - {(20000 * 1.025^(11))}{(1.03^(31) + 2 * 1.03^(20) * 1.025^(11))}1.03^(20)]}}{1.025^(20)}](https://img.qammunity.org/2021/formulas/business/college/50uft15fxeqbg4ai637g7qiyfppn71eq5g.png)

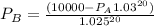

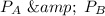

We want to find

so we have the last

so we have the last

values (in bold)-

values (in bold)-

![\to ([(20000 * 1.025^(11)))/((1.03^(31) + 2 * 1.03^(20) * 1.025^(11))] * 1.03^(10))](https://img.qammunity.org/2021/formulas/business/college/utrk6ui1ivbt17v4z6nkwlus0wn5mp7ndb.png)