Answer:

The size of the fund at the end of 7 years is $483.110

Step-by-step explanation:

Number of quarters = 4

We are given that the nominal rate of discount convertible quarterly is 4/41

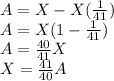

Discount rate in each quarter =

Let A is the value after discount and X is the original value:

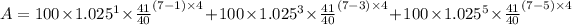

Now To calculate the value after 7 years we need to multiply each value by the interest raised to the correct power.

A=483.110

Hence the size of the fund at the end of 7 years is $483.110