Answer:

The net income is "$7600".

Step-by-step explanation:

The given values are:

Selling Price

= $19

Variable Cost

= $15

Company sells

= 3,300 units

Per unit contribution

= $4

Now,

The total contribution will be:

=

=

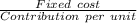

⇒ Break Even Point =

Now,

Calculation of the net income will be:

= Contribution - Fixed cost

=

=

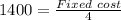

(4)

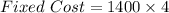

(4)