Answer:

The correct answer is "$8.65".

Step-by-step explanation:

The given question is incomplete. Please find attachment of the complete question.

The given values are:

Total stockholders equity

= 4980000

Preferred stock

= 1000000

Number of common stock issued

= 460000

So,

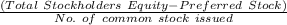

The book value per share of common stock will be:

=

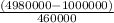

On putting the values, we get

=

=

=

$

$