Answer:

1. Discount

2. $449,298.47

3. $369,298.47 gain

4. land reduces by $80,000, investment increases by $449,298.47, reserves increases by $369,298.47

Step-by-step explanation:

Question 1

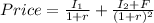

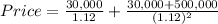

Using the formula below

where

I = interest rate, which is 6% of 500,000 = 30,000

F = Face value, 500,000

r = borrowing cost = 12%

Therefore, the price of the note at the time it was used for payment was

= $449,298.47.

As the price is lower than the face value of the note, the note was issued at a discount.

Question 2

The fair market value of the note is $449,298.47, the compute price in question 1.

Question 3

The gain/loss on the sale of the land

= sale price - purchase price

= $449,298.47 - 80,000

= $369,298.47.

Question 4

The transaction would affect Crabb & Co's balance sheet as follows.

Asset side:

land reduces by $80,000

investment increases by $449,298.47

Equity & liabilities side:

reserves increases by $369,298.47