Answer:

33.8%

Step-by-step explanation:

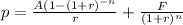

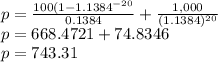

Purchase price of the bond will be computed using the formula below.

where A = annual coupon = 10% * 1000 = 100

r = yield to maturity = 0.1384

n = time to maturity = 20 years

F = face value = $1,000

p = price of the bond.

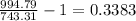

Therefore, if Janet sold the bond a year later for $994.79,

the profit on sale =

= 33.8% profit (rate of return).