Answer:

7.50%

Step-by-step explanation:

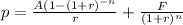

The formula to solve this problem is stated below.

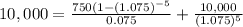

where p = price paid = $10,000

A = annual coupon payment = $750

n = tenor = 5 years

F = face value paid at maturity = $10,000

r, the unknown = rate of return.

Using extrapolation, the value of r that resolves the problem = 7.5%. The is expected since the price of the bond is the same as face value. As such, the rate of return was the same as

= 7.5%.

= 7.5%.

.

.