Answer:

The answer is "0.85 "

Step-by-step explanation:

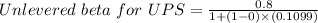

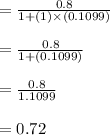

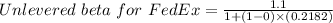

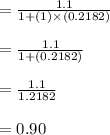

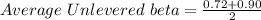

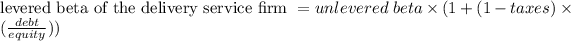

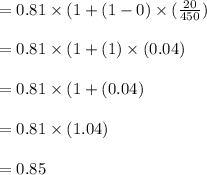

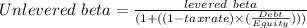

In order to locate a beta of the company, we must find the average beta of unlevered UPS and FedEx and find a levered beta of the company.

Price Outstanding shares(Billion) Market valu of equity(Billion) Market value of debt(billions) D/E Ratio

UPS 65 0.7 45.5 5 0.1099

FedEx 55 0.25 13.75 3 0.2182

taxes desn't matter , given in the question so, assumed to be 0