Answer:

The correct answer will be "1197.93".

Explanation:

According to the question:

Semi annual coupon:

=

=

Number of periods:

=

=

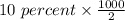

Semi annual YTM:

=

=

Now,

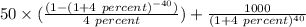

The market value of bond will be:

= PV of Coupons + PV of Par Value

On putting the values, we get

=

=

Note: percent = %