Answer:

account receivables 2,500,000 debit

sales revenue 2,500,000 credit

--to record sales on account--

sales returns and allowances 50,000 debit

account receivables 50,000 credit

--to record return and allowances--

cash 2,200,000 debit

account receivables 2,200,000 credit

--to record collections--

Allowance for doubtful accounts 41,000 debit

Account receivables 41,000 credit

--to record write-off of receivables--

Account receivables 15,000 credit

Allowance for doubtful accounts 15,000 debit

cash 15,000 debit

account receivables 15,000 credit

--to record recovery of write-off account--

Balance:

Account Receivalbes 809,000

Allowance (before adjustment) 11,000

adjusting entry:

bad debt expense 35,000 debit

Allowance for doubtful accounts 35,000 credit

Allowance after adjustment: 46,000

Account receivables TO: 3.75

Step-by-step explanation:

Account Receivables:

DEBIT CREDIT

600,000

2,500,000

50,000

2,200,000

41,000

15,000

809,000

Allowance:

DEBIT CREDIT

37,000

41,000

15,000

11,000

Aging: 46,000

Adjustment 35,000

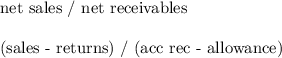

Acc Rec TO

beginning A/R 600,000 - 37,000 = 543,000

ending A/R 809,000 - 46,000 = 763,000

average: (763,000 + 543,000 ) / 2 = 653,000

(2,500,000 - 50,000) / 653,000 = 3,75191 = 3.75