Answer:

The price 3-years from now will be of $52,50

Step-by-step explanation:

We solve for g using the Gordon model:

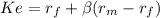

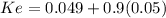

As we don't know the rate of return we solve ofr that fist using CAPM:

CAPM (Capital Assets Price Model)

risk free 0.049

market rate 0.099

premium market = market rate - risk free 0.05

beta(non diversifiable risk) 0.9

Ke 0.09400

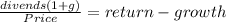

We plug that in the gordon equation and solve for g:

2.25 = 0.094 x 46 - g x 46

(2.25 - 4.324) / 46 = -g

-0.0450869565217391 = -g

g = 0.045087

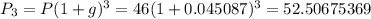

In the gordon model the price of the stock increases at the grow rate:

as P = D/(r-g)

P1 = D(1+g)/r-g)

P1 / P = D(1+g)/(r- g) / D/(r- g) = 1 + g