Answer:

A) 114 tons

C) $22800

D) $22807.02

Step-by-step explanation:

Given Data:

annual holding cost (H) = 25% * $2000

setup cost (s) = $10000

production rate = 20

weekly demand = 5 tons

first we have to calculate the Annual demand , holding cost and the usage rate:

Annual demand = 5 tons * 52 weeks

= 260 tons

Holding cost (H) = 25% * $2000

= $500

Usage rate = (production rate) / (customer demand)

= 20 / 5 = 4 tons

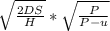

A) Optimal production batch size of the mill

Qp =

=

= 114 tons

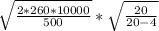

C) The annual inventory holding cost

Annual holding cost

=

Imax = ( Qp / P ) (p-u)

= (114 / 20 ) ( 20 - 4 )

= 91.2 tons

therefore Annual holding cost : = ( 91.2 / 2) * 500 = $22800

D) Annual setup cost of the plant

=

D = 260

Qp = 114

S = $10000

hence Annual setup cost of the plant

= (260/114) * 10000

= $22807.02