Answer:

The correct answer is "2,40,000". The further explanation is given below.

Step-by-step explanation:

The given fair value is:

= $240,000

The presentation in books of lessee will be:

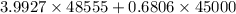

⇒

⇒

On putting the values, we get

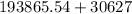

⇒

⇒

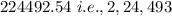

⇒

($)

($)

Presentation in books of Lessor , the fair value of assets will be

=

($)

($)