Answer:

c c c c c c c c c c c

//-!-!-!-!-!-!-!- {...} -!-!-!-!-!-!-!-!//

F0 30+X

on F0 we receive the 200,000 dollars

then each month (!) we made the installment payment (c)

this continues for the entire life of the mortgage until we reach the year 30 + X at which the mortgage ends and no more payment is done.

The outstanding amount will be the 200,000 less the capitalize installment over 10 + Y years.

Notice as the payments are monthly we use a monthly rate.

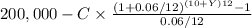

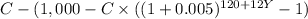

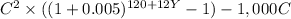

Outstanding after 10 + Y years

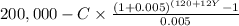

the interest component will be the outstanding balance times rate

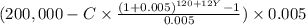

reduced expression:

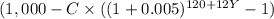

and the amortization of the installment quota less interest:

Step-by-step explanation:

As we don't know the values for X and Y we have to use the main formulas and reduce them the most we can.

If we are given values for X and Y we place them in the formulas and solve.