Answer:

Follows are the solution to this question:

Step-by-step explanation:

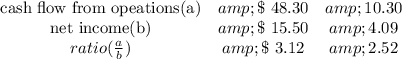

In 1988 blockbusters generated by operational cash flow exceeding $3 for each and every dollar of sales, which is defined in the below table:

1988 1987

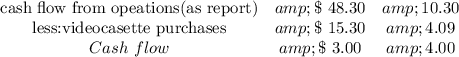

So, Mr. Seidler 's problem will be whether the cashflow for vidoe rentals will be reported throughout the operating activities or Whether investment.

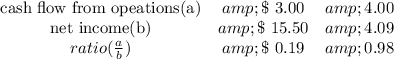

For the cash flow of such a behavioral pattern blockbuster, its ratio indicates also that blockbuster lost $0.19 for its net revenues reported by looks of mr. seidler in 1988 to each dollar in cash, as blockbuster was its world's largest video shop chain, getting its key sales from of the movie streaming of its operations.

1988 1987

It rate means which, Business retains stores since video cassettes have relatively low economic lives as the operational cash flow is much more consistent with the expected existence-generating sales of the asset.