Answer:

(a) $30,000

(b) $1,800

Step-by-step explanation:

(a)

Business Income allocated will be:

=

=

($)

($)

Qualified Business Income

=

($)

($)

For Qualified Business Income, deduction will be:

=

=

($)

($)

(b)

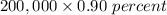

Whenever your net earnings from self-employment continue to increase $200,000 whether you're a singular filer, a 0.90 percent extra free Medicare tax may very well implement.

Additional Medicare Tax Liability will be:

=

![[(250,000 + 150,000) - 200,000]* 0.90 \ percent](https://img.qammunity.org/2021/formulas/business/college/kwffsmkiqzl40qq9furl6bxqhcx81f6886.png)

=

=

($)

($)