Answer:

Option c (21.4%) is the right approach.

Step-by-step explanation:

As we know.

- wA and wB = weights of the securities

- SDA and SDB = standard deviations

- Cor(A,B) = correlation coefficient.

On applying the formula:

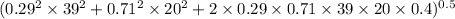

⇒

![SD \ Portfolio = [wA^2* SDA^2+wB^2* SDB^2+2* wA* wB* SDA* SDB* Cor(A,B)]^(0.5)](https://img.qammunity.org/2021/formulas/business/college/3x6e3iwl9dj1h8o0bxmv8pfltt71er0unr.png)

On substituting the values, we get

⇒

⇒

(%)

(%)