Answer:

A. The option that results in the smaller finance charge/interest is option 1

B. The option that will result in the smaller monthly payment is option 1

C. The interest they will earn in 4 years, I = $6,643.972

D. The time it will take for them to earn an interest of $500 by loaning $5,600 at 1.5% is approximately 5.95 years

Explanation:

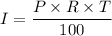

A. The simple interest, I, formula is given as follows;

Where;

P = The principal

R = The rate

T =The time given for the loan

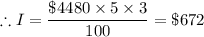

For Option 1 the first option, we have;

Down payment = 0.2 × $5600.00 = $1,120.00

Principal = $5600.00 - $1,120.00 = $4,480.00

For Option 2. the second option, we have;

P = $5600.00

The option that results in the smaller finance charge is option 1

B. For option 1, the total amount = Principal + Interest

∴ The total amount remaining = $4480 + $672 = $5,152

The monthly payment = A/N

Where;

A = The total amount yet to be paid out of the loan = $5,152

N = The number of time periods = 3 × 12 = 36 months

The monthly payment = $5,152/36 =

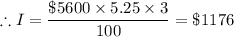

For option 2, the total amount = Principal + Interest

∴ The total amount remaining = $5,600 + $1176 = $6776

The monthly payment = A/N

Where;

A = The total amount yet to be paid out of the loan = $6,776

N = The number of time periods = 3 × 12 = 36 months

The monthly payment = $6,776/36 =

Therefore, the option that will result in the smaller monthly payment is option 1

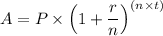

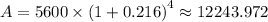

C. For a compound interest on a principal of $5,600 invested for 4 years in a savings account that gives an interest rate 21.6% per annum, we have;

We have, using the annual rate, rather than calculating for the monthly rate;

Therefore, the amount they will have in 4 years ≈ $ 12,243.972

The interest they will earn in 4 years, I = A - P ≈ $ 12,243.972 - $5,600 = $6,643.972

The interest they will earn in 4 years, I = $6,643.972

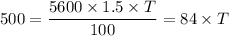

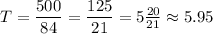

D. To earn an interest of $500 at an interest rate of 1.5%, we have;

From which we have;

Therefore, the time it will take for them to earn an interest of $500 by loaning $5,600 at 1.5% is approximately 5.95 years.