Answer:

The mortgage payment will be "$9258".

Step-by-step explanation:

The given values are:

Principal (P)

= 900000

Interest rate (i)

=

=

Total number of monthly payments (n)

=

=

The monthly payment `for the 30 years loan will be:

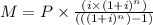

⇒

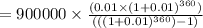

On putting the values, we get

Now,

The total amount paid will be:

($)

($)