Answer:

The value of ending inventory will be items of latest purchase.

Explanation:

Given that,

Lisa Company uses the periodic inventory system to account for inventories.

Information related to Lisa Company's inventory at October 31 is given,

Suppose, find the value of ending inventory using the FIFO cost assumption if 500 units remains on hand at october 31

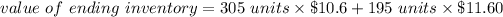

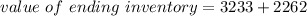

We need to calculate the value of ending inventory

Using FIFO method

Hence, The value of ending inventory will be items of latest purchase.