Answer:

Following are the answer to the given point.

Step-by-step explanation:

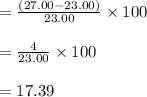

In point A:

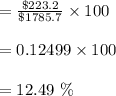

Calculating Percentage Return:

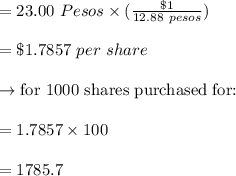

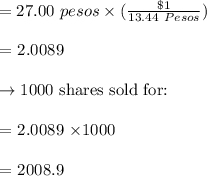

In point B:

calculating the Purchase value:

calculating the sale value:

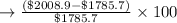

In point C:

calculating the Investmet Return:

In point D:

Due to varying currency rates, the two results are unique. That first return is more important since Joe lives in the United States, so, his real return or how much of his investment will be paid are measured.