Answer:

6.5%

Explanation:

You can find the tax rate by finding the percentage that the initial price increased by.

First, subtract the initial price from the price after taxes.

509.07 - 478 = 31.07

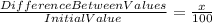

Knowing this we can find the tax rate using an equation like this.

Now we substitute in our values.

With X being the tax rate, we cross multiply both fractions.

3107 = 478x

From here, we solve for x by dividing 3107 by 478.

x = 6.5

Therefore the tax rate is 6.5 percent.

(Note that when you are trying to find the tax rate that you divide by the initial price before taxes to get the correct value.)