Answer:

The answer is "1201.7511".

Step-by-step explanation:

Formula:

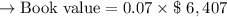

In this issue, maximum throughput capital is inventoried total assets at year-end 3 = 7% of the initial rate. It uses 7% because a computer is a MACRS class which takes three years. Because as the computer is now down 93% (33% for the first year, 45% for the second year, and 15% for the third year)

The rescue value is $344 and the stock of $817.

Financial rate = 39%

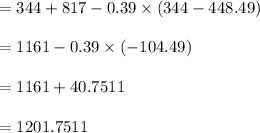

Now include these all values in the above described marginal working capital formula,

Middle of year 3 terminal value: