Answer:

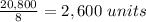

1. 2600 units

2. $72,800

3. 2,675 units

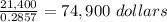

4. $74,900

Step-by-step explanation:

Provided,

Sales price per unit = $28

Variable cost per unit = $20

Thus, Contribution per unit = Sales price - variable cost = $28 - $20 = $8

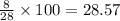

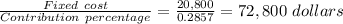

Contribution as percentage =

Fixed Cost = $20,800

1. Break even point in unit sales =

=

=

2. Break even point in dollars = Break even point in units

sales price per unit

sales price per unit

= 2,600

$28 = $72,800

$28 = $72,800

Or straight break even point in dollars =

3. In case fixed cost increase by $600

New fixed cost = $20,800 + $600 = $21,400

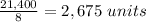

Thus, break even point in units shall be =

4. Break even point in sales =