Answer:

a) $66,949.44

b) $79,232.37

c) $79, 985.46

d) $80,000

Step-by-step explanation:

a) Value of return received per year = $9,600

Rate of interest = 12%

Period = 16 years

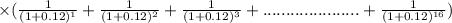

Thus, value of investment today shall be the discounted value of returns at the rate of 12%

= $9,600

= $9,600

= $66,949.44

b) Value of return received per year = $9,600

Rate of interest = 12%

Period = 41 years

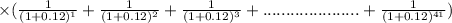

Thus, value of investment today shall be the discounted value of returns at the rate of 12%

= $9,600

= $79,232.37

c) Value of return received per year = $9,600

Rate of interest = 12%

Period = 41 years

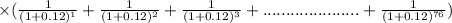

Thus, value of investment today shall be the discounted value of returns at the rate of 12%

= $9,600

= $79,985.46

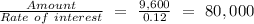

d) Value of return received till infinite period

=

= $80,000