Answer:

The special return will be for 23,330.11 at year 3

Step-by-step explanation:

we know that the expected return AKA internal rate of return is 12.30 per year

we set up the time-line for the investment:

F0 -56,000 investment

constant return of 12,000 for 5 years.

additional return at F3

F0 + PV of the F3 return + PV of the 12,000 annuity = 0

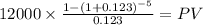

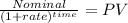

present value of the annuity:

C 12,000.00

time 5

rate 0.123

PV $42,937.7486

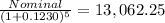

Present value of the additional return:

56,000 - 42,937.75 = 13,062.25

Now, we know that this is the discounted amount of the nominal return at 12.30% during 3 years:

Nominal = 23,330.11