Answer:

The company could pay at most $ 187,083.73 for the machine

Missing information:

effective monthly interest rate j = 0.4%

Step-by-step explanation:

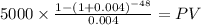

We calculate the present value of the employee's salaries using the annuity formula

C 5,000.00

time 48 (4 years x 12 month per year

rate 0.004 (0.4% = 0.4 / 100 = 0.004)

PV $217,971.2447

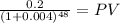

Now the PV factor of 0.20 of a dollar to represent the 20% of the machine cost being recovered after four years:

Maturity $0.20

time 48.00

rate 0.00400

PV 0.1651

now, we construct the equation:

217,971,25 - 0.1651X = X

When X is the maximum amount we could purchase the machine.

217,971,25 = X ( 1 + 0.1651)

217,971,25 / 1.1651 = X

X = $ 187.083,7267

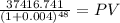

We verify this:

Cost less PV of the salaries plus PV of the residual value = 0

Maturity $ 187,083.73 x 20% = $37,416.74

time 48.00

rate 0.00400

PV of the residual value 30,892.1221

Net present value of the investment:

187.083,70- 217,971.25 + 30,892.1221 ≅ 0

as there is rounding involve there is a minimal difference but we can be satisfy with the answer.