Answer:

The company should deposit $74,954.02

Step-by-step explanation:

We have an annuity with a variable installment with arithmetic progression.

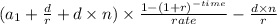

We plug our values:

C = 24,000

r = -2,000

r = 0.15

n = 6

And we get a PV of 74,954.02

We can build the table to verify:

Beginning Interest Tech payment Endng

1 74,954.02 11,243.11 24,000.00 62,197.14

2 62,197.14 9,329.58 22,000.00 49,526.72

3 49,526.72 7,429.01 20,000.00 36,955.73

4 36,955.73 5,543.36 18,000.00 24,499.09

5 24,499.09 3,674.87 16,000.00 12,173.96

6 12,173.96 1,826.10 14,000.00 0.06

(there is a 6 cent mistake due to rounding but without it It will be zero-out)