Answer :

Depends on the rate compound interest is accrued. See answers.

Explanation:

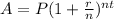

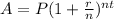

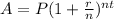

We need the compound interest formula which is:

A = final amount

P = initial principal balance

r = interest rate

n = number of times interest applied per time period

t = number of time periods elapsed

It doesn't say how frequently the interest is compounded, so we will do monthly, quarterly, and yearly.

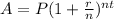

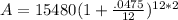

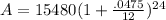

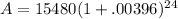

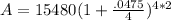

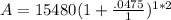

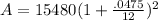

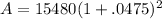

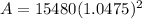

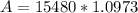

MONTHLY

So we know the car costs $25,480 and he made a down payment of $10,000. By subtracting the down payment from the purchase price we find the loan amount.

$25,480 - $10,000 = $15,480

P = 15,480

r = 4.75% = .0475

n = 12 (12 months in a year)

t = 2

Plug everything into the compound interest formula.

Mr. Lee paid $17,016.14 when the bill came due at 2 years with interest compounded monthly.

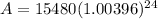

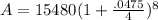

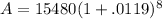

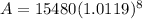

QUARTERLY

P = 15,480

r = 4.75% = .0475

n = 4 (4 quarters in a year)

t = 2

Mr. Lee paid $17,013.20 when the bill came due at 2 years with interest compounded quarterly.

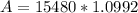

YEARLY

P = 15,480

r = 4.75% = .0475

n = 1

t = 2

Mr. Lee paid $16,985.53 when the bill came due at 2 years with interest compounded yearly.